Earned income credit calculator 2021

Find additional assistance from the experts at HR Block. Answer some questions to see if you qualify.

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

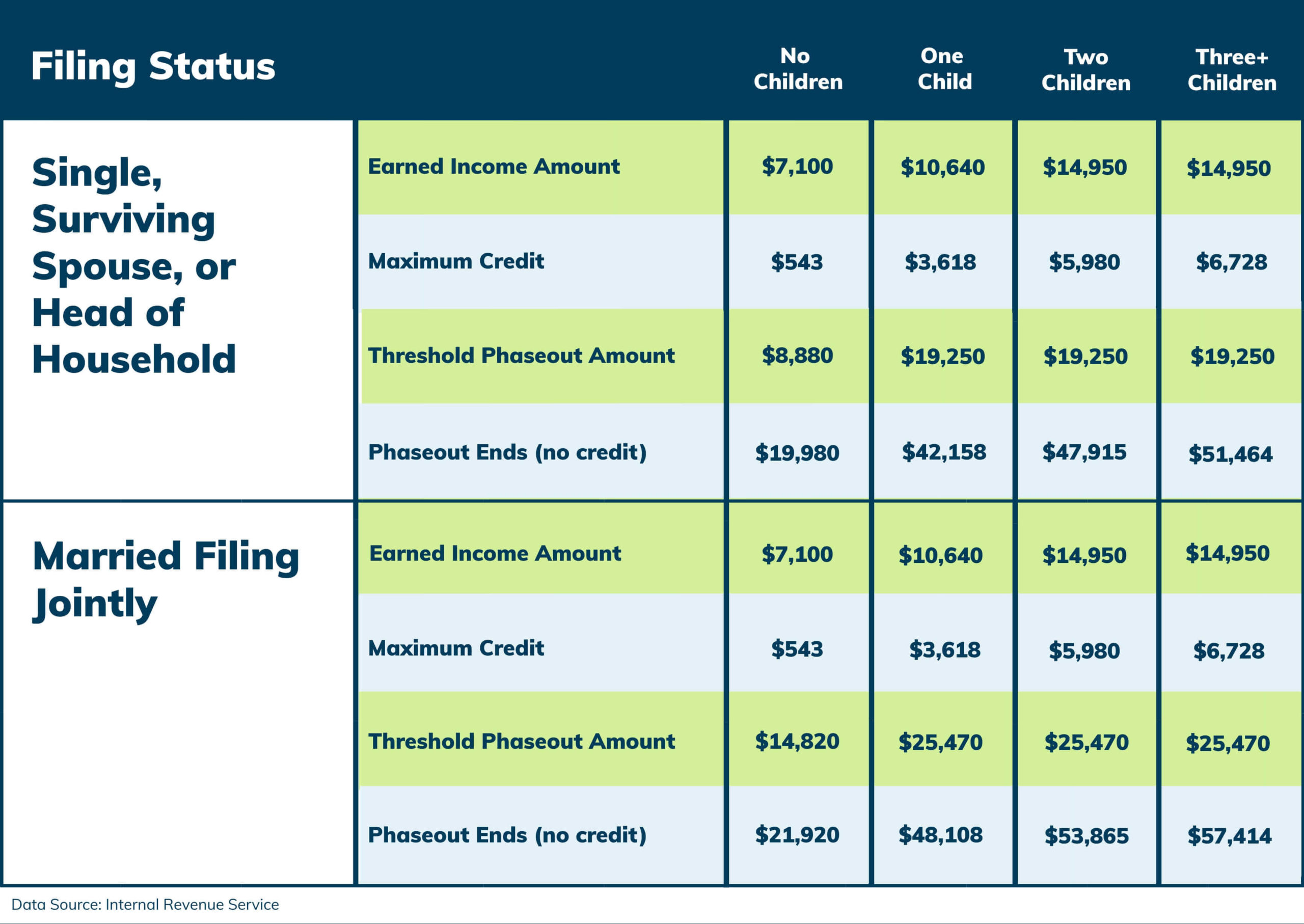

The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

. 2021 Forms This 2021 Earned Income Tax Credit calculator is for Tax Year 2021 only. Ad Do You Own a Business w 5 or More W-2s. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

Enter the number of children in your family that qualify for the Earned Income Credit EIC. See If You Qualify. If you elected to use your 2019 earned income in calculating your 2021 federal earned income credit you must also use your 2019 earned income in calculating your.

Taxpayers with low earnings by reducing the amount of tax owed on a dollar-for-dollar basis. Ad Do You Own a Business w 5 or More W-2s. First they find the 25300-25350 taxable income line.

Ad Our Tax Professionals Can Help Determine If You Qualify for the ERTC from the IRS. Election to use prior-year earned income You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more. To calculate your allowable EIC for 2021 you can use either your 2019 earned income or your 2021 earned income whichever will give you a bigger credit.

Owners Can Receive Up to 26000 Per Employee. Build Your Future With a Firm that has 85 Years of Investment Experience. To qualify for the EITC you must.

This is usually your earned income entered above plus any interest dividends or capital gains. Well Handle All Your Filing. Owners Can Receive Up to 26000 Per Employee.

Ad Try Our Free And Simple Tax Refund Calculator. Required Field How much did you earn from your California jobs or self-employment in. Request Your Free ERC Analysis.

Next they find the column for. Brown are filing a joint return. See If You Qualify.

Their taxable income on Form 1040 line 15 is 25300. Use the Earned Income Tax Credit calculator from the IRS to see if you qualify for the EITC. Have worked and earned income under 57414 Have investment income below 10000 in the tax year 2021 Have a valid Social Security.

Architecture Construction Engineering Software Tech More. Spring into wool mytv digital. Find out how much you could get back Required Field.

The IRS has a set of three requirements that must be met to have a child considered qualified. Ad Let Moss Adams Reduce Your Income Tax Liability with an Energy Tax Credit. The earned income credit which may also be referred to as the Earned Income Tax Credit EITC is a refundable tax credit.

Request Your Free ERC Analysis. 100 Accurate Calculations Guaranteed. You can elect to use your 2019.

The EITC is based on how many children you have and how much you make per year. Earned Income Credit Calculator 2021 2022. Discover The Answers You Need Here.

You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income. If you qualify you can use the credit to reduce the taxes you owe. The EIC or EITC is a refundable tax credit for taxpayers who have low or moderate incomes.

This can be from wages salary tips employer-based disability self-employment income military pay or union strike benefits. The first is that you work and earn income. Earned Income Tax Credit Calculator.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. The California Earned Income Tax Credit CalEITC is a refundable cash back tax credit for qualified low-to-moderate income Californians. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

If you choose to. Earned Income Tax Credit for Tax Year 2021 No Children One Child Two Children Three or More Children. Get up to 26K per employee from the IRS with The Employee Retention Tax Credit.

Maximum 2021 Credit Amount. The earned-income credit EIC is a refundable tax credit that helps certain US. The maximum amount you can get from this credit is 6660 for the tax year which is a.

Ad Aprio performs hundreds of RD Tax Credit studies each year. Well Handle All Your Filing. Discover how our customized services can help you plan for whats next.

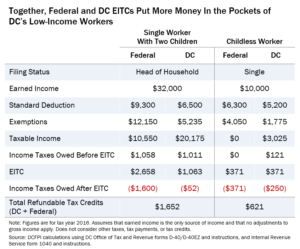

Federal Earned Income Credit Financial Education

Earned Income Credit Calculator H R Block

Earned Income Tax Credit For 2020 Check Your Eligibility

What Are Marriage Penalties And Bonuses Tax Policy Center

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

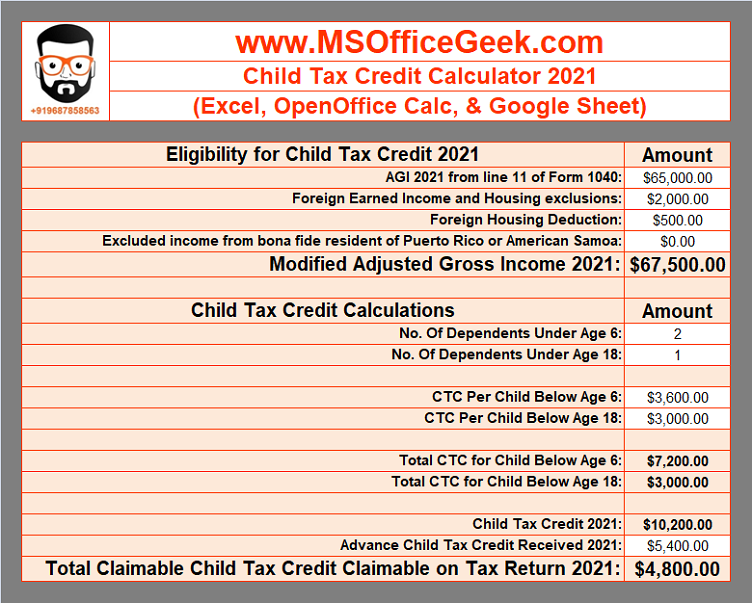

Try The Child Tax Credit Calculator For 2022 2023

Earned Income Tax Credit Parameters 1975 2000 Dollar Amounts Download Table

Dc S Earned Income Tax Credit

Child Tax Credit Schedule 8812 H R Block

Earned Income Tax Credit Calculator Taxact Blog

Ready To Use Child Tax Credit Calculator 2021 Msofficegeek

Earned Income Credit Eitc Definition Who Qualifies Nerdwallet

![]()

1040 Income Tax Calculator Free Tax Return Estimator Jackson Hewitt

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

2021 Tax Changes And Tax Brackets

Earned Income Credit Eic

Earned Income Credit Eic